san antonio property tax rate 2020

The median property tax in Bexar County Texas is 2484 per year for a home worth the median value of 117100. CITY OF SAN ANTONIO.

Property Taxes By State Quicken Loans

You can pay your property tax online using any of the payment methods listed above.

. City of San Antonio Attn. City property tax rate increase. 0125 dedicated to the city of san antonio ready to work program.

PersonDepartment PO Box. Box is strongly encouraged for all incoming mail. Thereafter interest will continue to be added at the.

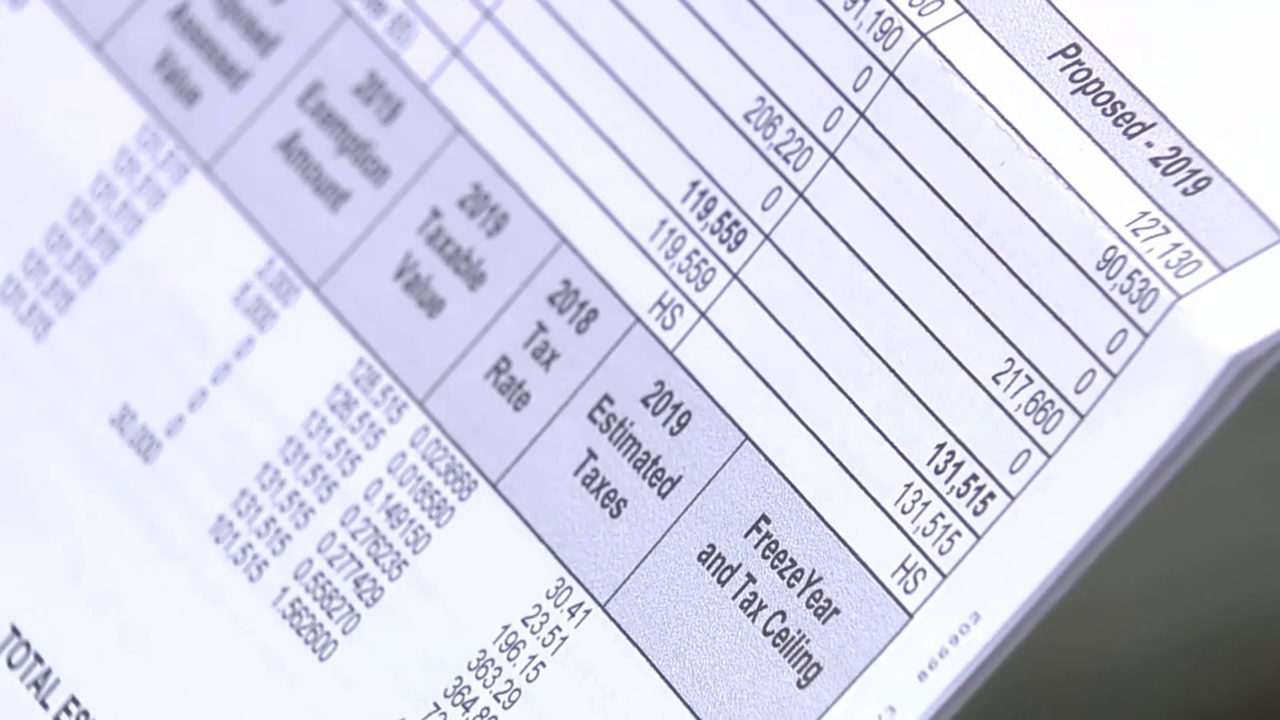

They are calculated based on the total property value and total. Rates will vary and will be posted upon arrival. 65 rows 2020 Official Tax Rates Exemptions.

China Grove which has a combined total rate of 172 percent has the lowest property tax rate in the San Antonio area and Poteet with a combined total rate of 322 percent has the highest. The City will set the property tax rate for the next year as part of its annual budget process. The San Antonio City Council and Mayor Ron Nirenberg unanimously approved a 2.

65 rows When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage. San Antonio Area Exemption Comparison. Sa May Be Forced To Cut Property Tax Rate.

The rates are given per. PROPOSED ANNUAL OPERATING AND CAPITAL BUDGET. It is poised to lower the rate for the eighth time in thirty years as part of adoption of its.

Estimated Tax Collection Rate. San Antonio TX 78205 Mailing Address The Citys PO. Property tax rates in Texas are recalculated each year after appraisers have evaluated all the property in the county.

On the lower spectrum of tax rates when it comes to incorporated cities Selmas total property tax rate is 237 per hundred dollars. If City Council wants to implement a homestead. In fiscal year 2022 the MO tax rate will be 34677 cents per 100 taxable value.

The Official Tax Rate Each tax year local government officials such as City Council Members School Board Members and Commissioners Court examine the taxing units needs for. Thats nearly 13 lower than San Antonios. 79 rows Property Tax Rate Calculation Worksheets Senate Bill 2 SB2 of the 86 th Texas Legislature requires the Tax Assessor-Collector from each county to post their website the.

New Rollback Rate of 35 starting in FY 2021. 3582460047 Debt to Assessed Valuation. 2021-2022 Debt Service Expenditures estimated.

Example - Penalty and interest will be added at a rate of 7 for February 2 per month for March through June and 3 for July. Outstanding Unlimited Tax Debt. Pursuant with the Texas Property Tax Code properties are taxed according to their fair market value.

Bexar County collects on average 212 of a propertys assessed fair. San Antonio property taxes make up about 20 of a. Between 2015 and 2020 property values have not increased by an average of more than 7 per year.

In each case these rates are calculated by dividing the total amount of taxes by the current taxable value with adjustments as required by state law. The City of San Antonio has not raised its property tax rate in 25 years and has lowered it four times in the past decade. For example the tax on a property appraised at 10000 will be ten times greater than a.

San antonios current sales tax rate is 8250 and is distributed as follows. 1000 city of san antonio. FISCAL YEAR 2022.

U S Cities With The Highest Property Taxes

Why Are Texas Property Taxes So High Home Tax Solutions

Comal And Guadalupe Counties Approve Discretionary Tax Increase Measures Community Impact

Tax Rates And Local Exemptions Across Texas San Antonio Report

U S Cities With The Highest Property Taxes

Property Tax Calculator Smartasset

Significant Changes Coming To Texas Property Tax System Texas Apartment Association

Property Taxes Sugar Land Tx Official Website

Texas Lawmakers Pass Property Tax Cut For New Homeowners Next Relief For Seniors And The Disabled

Property Tax Relief Programs Don T Reach Many Homeowners Of Color Shelterforce

City Of San Antonio Fiscal Year 2023 Proposed Budget Includes More Property Tax Relief Energy Credits And Invests In Employees And Community Infrastructure The City Of San Antonio Official City Website

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

How Property Taxes Have Changed Skyrocketed In San Antonio Neighborhoods

Bexar County Cities Ranked By Property Tax Rate Total During 2016 San Antonio Business Journal

How To Protest Your Texas Property Taxes Win Home Tax Solutions

Cities Of Round Rock Pflugerville Hutto Increase Budgets Adjust Tax Rates To Manage Growth Community Impact