inherited annuity tax calculator

An inherited IRA is an individual retirement account opened when you inherit a tax-advantaged retirement plan including an IRA or a retirement-sponsored plan such as a 401k following the death. If they choose a lump sum beneficiaries must pay owed taxes.

He has been providing this model updated yearly since 1996.

. If your annuity is now worth 11000 youre younger than 59½ and you take your 11000 back you will owe ordinary income tax plus a 10 penalty on 1000 the part of the distribution that. A fixed annuity is a tax-deferred high yield savings account for retirement competing with the best CD rates today. With this calculator you can find several things.

An annuity is an investment that provides a series of payments in exchange for an initial lump sum. RMD Rules For Inherited IRAs. Income annuities can provide the confidence that you will have guaranteed retirement income for life or a set period of time.

If you dont take the distribution by the December 31 deadline youll pay a 50 tax penalty in addition to regular income tax on the amount that should have been withdrawn. Whether you agreed to a structured settlement to resolve a personal injury medical malpractice or wrongful death lawsuit or you inherited a structured settlement from a loved one this calculator can estimate the current cash value of your future payments. A deferred annuity is an insurance contract that generates income for retirement.

If so youve come to the right place. Compare 143 fixed annuities 2 to 10 years in length to achieve the highest fixed annuity rates in the United States. How taxes are paid on an inherited annuity will depend on the payout structure selected and the status of the beneficiary.

Use this income annuity calculator to get an annuity income estimate in just a few steps. Compare 143 fixed annuity rates. The creator Glenn Reeves doesnt guarantee that they meet the formatting requirements of the IRS.

In addition surrender charges may apply. Withdrawals may be subject to regular income tax and if made prior to age 59 may be subject to a 10 IRS penalty. You shouldnt wait till the last minute to do the paperwork though.

In fact most people do take the money in one lump sum at the end of the year says Copeland. So give it a try. People inheriting an annuity owe income tax on the difference between the principal paid into the annuity and the value of the annuity at the annuitants death.

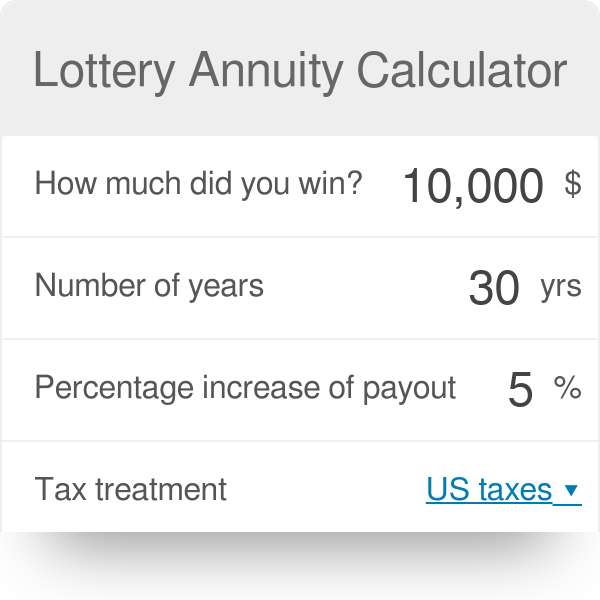

ANNUITY TAX ADVANTAGES CALCULATOR. This annuity calculator is designed to help you plan for a secure and comfortable retirement. An annuity is a contractual financial product sold by financial institutions that is designed to accept and grow funds from an individual and then upon annuitization pay out a stream.

Federal Income Tax Form 1040 Excel Spreadsheet Income Tax Calculator. 2021-2022 Tax Brackets Tax Calculator. The payment that would deplete the fund in a.

Many clients purchase income annuities to help cover their essential expenses as defined by them in retirement. A structured settlement is a negotiated arrangement whereby an injured party in a court case receives a settlement as a. A Federal income tax spreadsheet calculator that will prepare the form 1040 and many of the supporting 1040 forms.

It considers your current age retirement age and desired monthly income. Keep in mind this provision only applies to spouseschildren named as beneficiaries must pay taxes on any inherited annuities. In addition the calculator will tell you how much money you need to save each month to achieve your retirement goals.

Financial Calculators Personal Finance The Annuity Expert

Annuity Taxation How Various Annuities Are Taxed

Annuity Beneficiaries Inheriting An Annuity After Death

The Best Annuity Calculator 17 Retirement Planning Tools

Annuity Exclusion Ratio What It Is And How It Works

Mom Is Worried About Tax Hit From Annuity

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities3-f5e4d156c37b4fffb4f150266cea32b1.png)

Calculating Present And Future Value Of Annuities

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities5-d76f3a6c09a54703afa365a16aff6607.png)

Calculating Present And Future Value Of Annuities

Inherited Annuity Tax Guide For Beneficiaries

Annuity Taxation How Various Annuities Are Taxed

Annuity Beneficiaries Inheriting An Annuity After Death

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities4-2813a92710984e7da733f6c5b924d0fb.png)

Calculating Present And Future Value Of Annuities

How To Avoid Paying Taxes On An Inherited Annuity Smartasset

What Is The Best Thing To Do With An Inherited Annuity Due

Inherited Annuity Tax Guide For Beneficiaries

How To Avoid Paying Taxes On An Inherited Annuity Smartasset

The Best Annuity Calculator 17 Retirement Planning Tools

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities1-0cea56f3b4514e44bed8f45d9c74011e.png)